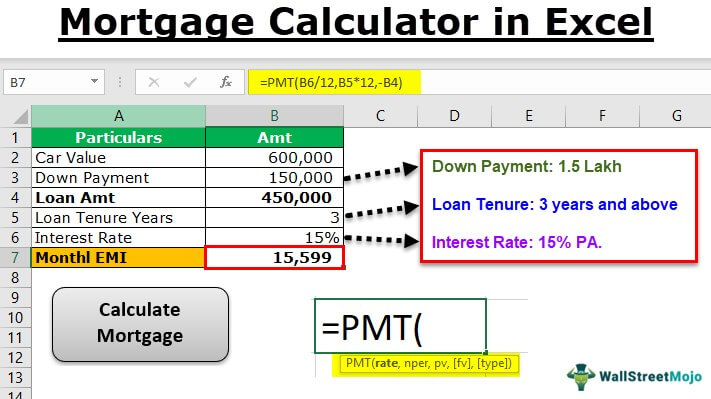

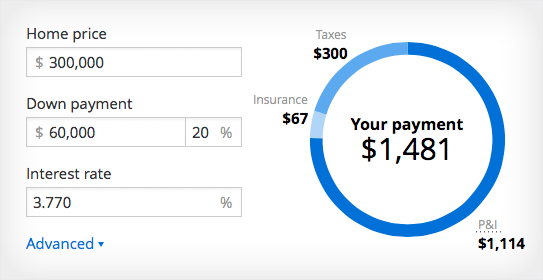

The inconsistencies and the frequent underestimations of the tax and insurance fees prove that the Zillow mortgage calculator is unreliable. The improved accuracy is because the number is taken directly from the county assessor’s office in the “Price and tax history” section. You can see it at the bottom of the listing page on Zillow. I should point out that you can find a more accurate number for your mortgage payment. The Zillow mortgage estimate toward the top of individual listing pages on Zillow is off because of the miscalculations. Due to the low insurance and tax estimations, the resulting number is lower than it should be. I also recommend that you be careful with the insurance and taxes, as it seems that the Zillow mortgage calculator always underestimates these costs. If you were to enter a number below 20, the calculator would readjust its calculations and visualize a mortgage estimate that accounts for the down payment and loan payment. If you enter a down payment that is 20% or higher, you will quickly notice that the Zillow mortgage calculator doesn’t register it at all. There is one main flaw with the calculator itself, and it refers to the down payment. Unfortunately, this isn’t the complete picture. The inclusion of these additional fees should mean that the Zillow mortgage estimate is, in fact, accurate. In reality, these costs represent a rather substantial part of the actual payment, so you should not neglect them. Many users ignore these costs when looking for estimations on their monthly mortgage payment, which may be detrimental if they base their decision solely on the calculator results. Not only that, but you will also receive detailed information about your potential private mortgage insurance (PMI), property taxes, home insurance, and homeowners association (HOA) fees. It promises to estimate your total mortgage payment, including principal and interest.

On the surface, this Zillow feature has a neat and simplistic design and seems like a helpful mortgage calculator that will do solid work for you. Let’s dive into this topic already! How Accurate Is Zillow Mortgage Estimate?Īs I already mentioned, the Zillow mortgage estimate can be way off due to the inability of the calculator learning model to examine fundamental aspects that determine the final result. However, there are many factors that can affect a home’s value, and the algorithm is not always able to take these factors into account.Īdditionally, the algorithm can be affected by changes in the real estate market, so the estimates may change from month to month.īy the end of the article, you will have learned everything you need about the accuracy of the Zillow calculator. Zillow’s monthly estimates are based on a computer algorithm that looks at recent sales in a neighborhood and then tries to estimate the value of every home in that neighborhood. I am taking it upon myself to explain the Zillow mortgage calculator functions and how you can get a relatively accurate representation of an estimated monthly mortgage payment.Īre Zillow monthly estimates accurate? Zillow’s monthly estimates are not accurate. It is impossible to define the main reasons for the flawed Zillow’s system in a couple of sentences. To get an accurate estimate of your mortgage rate and monthly payment, speak to a loan officer. It is not a guarantee of your final mortgage rate or monthly payment. Zillow’s mortgage estimate is based on public data and current market trends. However, it can still be helpful in getting an idea of what your mortgage payments might be.

The algorithm used by Zillow to generate the mortgage estimate has some flaws, so it should only be used as a rough guide.

While there are many such calculators, the Zillow one is arguably the most popular choice among users.īut how accurate is the Zillow mortgage estimate? Zillow Mortgage Estimate is not 100% accurate. We, as humans, can do so much, so it is wise to opt for a mortgage calculator that will do the sophisticated calculations instead of us. Taking out a mortgage when purchasing the house of your dreams is a risk that needs a lot of thought due to the complexity of the purchase and the sheer volume of factors you have to consider.

0 kommentar(er)

0 kommentar(er)